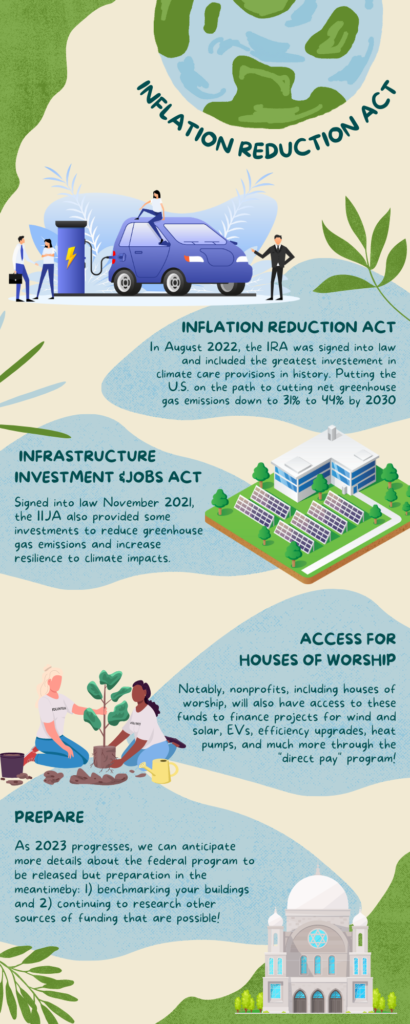

In August 2022, the Inflation Reduction Act (IRA) was signed into law and included the greatest investment in climate care provisions in history. The IRA puts the United States on the path to cutting greenhouse gas net emissions by up to 44% by 2023. Most notable for our community – nonprofits, including houses of worship, will also have access to these funds to finance projects for wind and solar, EVs, efficiency upgrades, heat pumps, and much more for nonprofits.

Houses of worship now have easier access to clean energy funds and tax credits through a program called “direct pay.” Before the IRA, only homeowners and commercial entities with some tax liability could claim tax credits when installing solar panels, wind turbines, or other eligible technologies on an eligible property. Now, the “direct pay” option means non-taxable entities can also benefit from these credits.

The bipartisan Infrastructure Investment and Jobs Act (IIJA) signed into law in November 2021 also provided some investments to reduce greenhouse gas emissions and increase resilience to climate impacts.

The IIJA provides the Department of Energy with $50 million over five years for a new program, the Energy Efficiency Materials Pilot Program for nonprofit organizations. This program will provide grants of up to $200,000 to nonprofits to improve the energy efficiency of their facilities. This program is currently still being developed but it’s expected that by February 2023 program details will be available.

As people of faith and conscience, this is our opportunity to help bring about a just transition to a clean energy economy based on the values we all share: caring for one another and for our common home.

Faith communities can leverage these new or expanded federal programs for energy and resiliency improvements. (https://interfaithpowerandlight.org/federal-funding/)

As 2023 progresses, we can anticipate more details about the federal program to be released but preparation in the meantime is key! Here are two things that can be done if your house of worship hasn’t done it already:

- Benchmark your buildings. It is helpful to have ready items such as a full year’s worth of recent utility bills, know construction dates for your buildings, and track occupancy rates for the building. Programs such as EnviroStars provide a checklist that covers a variety of greening areas to further benchmark where your building is at. Their program also includes ideas for implementing actions into the foundation and life of your house of worship.

- Research other sources of funding that are possible. Whether it’s through statewide, local, or utility company sources, having additional funding for greening projects will be beneficial. Your congregation should also look into denominational funding sources for building improvements.

By knowing more about your building, its needs, and costs for projects, you are able to take advantage of direct pay opportunities for funding projects and continue your work in creating healthy and sustainable communities.

Resources

National Interfaith Power & Light has put together a faith community resource to help identify federal grant and tax credit opportunities that are available and are working to keep it up to date as new program guidance becomes available.

The Environmental and Energy Study Institute also has a page on Energy Efficiency for Nonprofits which includes stories about the work that the faith community is doing as well as advice on financing energy efficiency projects.

Energy Innovation® used their free and open-source Energy Policy Simulator to study potential state-level benefits on economic growth, jobs, and public health in Washington from the IRA. We focus this analysis on clean electricity and clean vehicle tax credits, given the outsized impact of these tax credits on jobs and the economy.

Tune into Interfaith Power & Light’s Solar Direct Pay 101: Federal Funding for Houses of Worship about Direct Pay funding available for solar on buildings in the United States owned by non-profit organizations through the Inflation Reduction Act.

IRS Website Resources:

- Elective Pay Overview

- Clean Vehicle and Energy Credits

- Elective Pay and Transferability

- Pre-Registration User Guide

- FAQ Document

EESI Direct Pay for Nonprofits fact sheet

White House Direct Pay / Clean Energy

Department of Energy: Federal Solar Tax Credits for Businesses